| Home > General (L405) > PHEV Spec |

|

|

|

| CUE99T Member Since: 02 Oct 2011 Location: Glasgow Posts: 779

|

I take that back!! Mike from Pentland has just told me that no 22" wheels will be available and sadly only a fixed towbar will be available due to battery placement!!

|

||

|

| CS Member Since: 14 Apr 2015 Location: Edinburgh Posts: 1390

|

If they are to have the same non-deployable towbar as on other 405s then it is very quick and easy to remove/replace, so not a huge hardship. The removable end goes in a tailored pouch that can be tied to the loadspace tie-down loop on the driver side to stop it moving about in the loadspace (well, in the standard boot anyway). Note that the towing weight limit is much lower in the PHEV, 2,500kg. Only Range Rovers since 1988 |

||

|

| CUE99T Member Since: 02 Oct 2011 Location: Glasgow Posts: 779

|

Thanks CS.

|

||

|

| oop north Member Since: 29 Mar 2014 Location: Preston-ish Posts: 18

|

Who told you the tax figure? Looks wrong to me. Looks like based on 9% of list price x 40% tax - but 9% was last year’s figure for under 50g/km of co2 - this year its 13% and next year 16% and I think the RR phev is over 50g sonwill be more expensive |

||

|

| oop north Member Since: 29 Mar 2014 Location: Preston-ish Posts: 18

|

I have looked at some company car tax tables now and based on LR website’s 72g/km figure the current year bik is 16% of list, next year also 16% and 2020-21 it goes to 19%. So in rough figures for 40% taxpayer a £114k FFRR (Nb this asssumes you don’t pick any options that push the co2 over 74g) will cost £7,300. In 2020-21 that goes up to £8664. A lot better than a diesel but still not as cheap as you might be thinking |

||

|

| CUE99T Member Since: 02 Oct 2011 Location: Glasgow Posts: 779

|

Not FFRR relevant, but rlevant to the conversation, but why would you be a 40% tax payer if you own your own company???? all smug in my new plug!

|

||

|

| CUE99T Member Since: 02 Oct 2011 Location: Glasgow Posts: 779

|

For the figures above I used the HMRC calc tool using 72grams of co2 as per the website. Or was it 74, anyway as long as it's under 75 you're fine. all smug in my new plug!

|

||

|

| oop north Member Since: 29 Mar 2014 Location: Preston-ish Posts: 18

|

That might look like a simple question, but I am not sure exactly what you are asking. Is it because someone getting dividends doesn’t pay 40% tax? Looking at income tax alone if you have a company car you will suffer that at 40% if your total income is below 100k but above 45-ish (or from 123-ish to 150 - it’s 60% it 100 to 123ish). The dividend tax rate doesn’t apply to co car bik Though that ignores the employer national insurance that the company suffers on the bik at 13.8% less the corporation tax relief on that. As an appalling oversimplification I sort of assume the saved vat on the contract hire balances the nic out |

||

|

| CS Member Since: 14 Apr 2015 Location: Edinburgh Posts: 1390

|

40%? Assuming CUE 99T is a Scottish taxpayer the rate would be 41% now, given the "more progressive" tax rates applicable in Scotland... Only Range Rovers since 1988 |

||

|

| CUE99T Member Since: 02 Oct 2011 Location: Glasgow Posts: 779

|

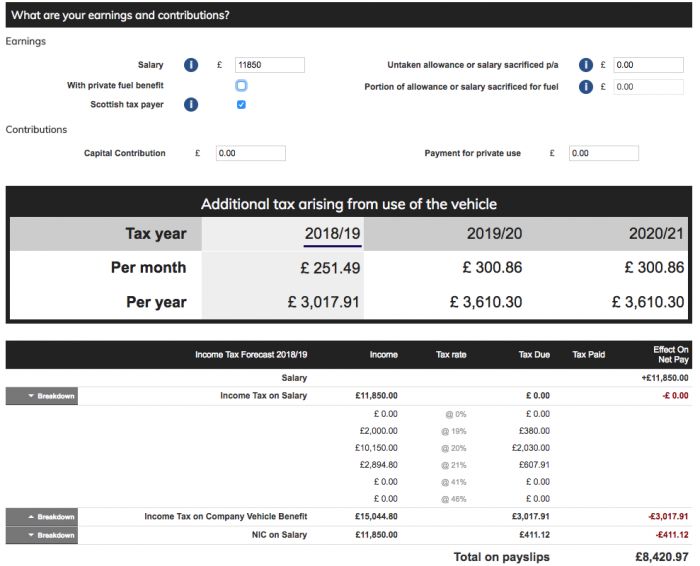

OK, this is my accurate picture. I don't see the point in using private fuel allowance so this is what I will pay for a VSE with 0 contribution from myself.

|

||||

|

| oop north Member Since: 29 Mar 2014 Location: Preston-ish Posts: 18

|

Ok - two quick points then I will go away again and give people less chance to catch me out |

||

|

| CUE99T Member Since: 02 Oct 2011 Location: Glasgow Posts: 779

|

it's all good chat mate, we are all friends here, and tbh I am not a tax expert but love a good challenge on reducing my tax bills!! lol

|

||

|

| oop north Member Since: 29 Mar 2014 Location: Preston-ish Posts: 18

|

Ha! Not asking for more details |

||

|

| CUE99T Member Since: 02 Oct 2011 Location: Glasgow Posts: 779

|

Top man!

|

||

|

|

|

| All times are GMT |

< Previous Topic | Next Topic > |

Posting Rules

|

Site Copyright © 2006-2025 Futuranet Ltd & Martin Lewis

![]()